Have You Considered the Employee Retention Credit?

If you did not receive a Paycheck Protection Program loan, you may want to consider the CARES Act Employee Retention Credit.

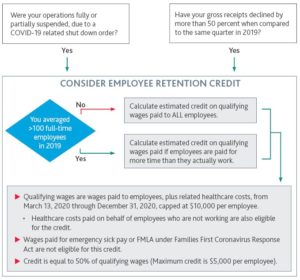

The Employee Retention Credit (ERC) may offer a tax credit up to $5,000 per employee for wages paid from March 13 to December 31, 2020. It’s one of the relief programs within the Coronavirus Aid, Relief, and Economic Security (CARES) Act for employers who continue to pay their employees.

The credit may be available to employers whose:

- Operations were fully or partially suspended due to novel coronavirus (COVID-19)-related limits on commerce, travel, or group meetings; or

- Gross receipts for the 2020 quarter decline more than 50% when compared to the same 2019 quarter. Eligibility for the credit continues through the 2020 quarter in which gross receipts are greater than 80% of gross receipts in the same 2019 quarter.

The credit works differently depending on company size. Employers with more than 100 employees are eligible for a tax credit of 50% of wages, up to $10,000 per employee, paid to employees who are NOT performing services. Employers with 100 or fewer employees are eligible for the same amount, paid to all employees, regardless of amount of services performed. The maximum for both is $5,000 per employee. The following chart illustrates eligibility.

Another option to consider is the Main Street Lending Program, also part of the CARES Act. The program is designed to support lending to small and medium-sized businesses that were in good financial standing before the onset of COVID-19.

The program facilitates new loans and expands existing ones as follows:

- The Main Street New Loan Facility offers loans between $500,000 and potentially up to $25 million

- The Main Street Expanded Loan Facility offers loans between $10 million and potentially up to $200 million

- The Main Street Priority Loan Facility is for borrowers who are more leveraged, with a minimum loan amount of $500,000 and a maximum potentially up to $25 million

We anticipate additional guidance and details regarding CARES Act legislation, so it is important to stay abreast of changes and contact a professional for assistance in navigation this legislation. If you have questions, please reach out to our team. We are always here to help.